Refinancing your auto loan is as easy as 1, 2, 3.

Step 1

Apply in 5 minutes or less.

Getting pre-qualified is easy and free. Your savings journey starts by sharing a few details about yourself and your vehicle.

Apply online in as little as five minutes or call our virtual team.

Step 2

Lock in your rate.

Once you're pre-approved, we'll walk you through the steps to complete your credit check and get you the best rate and term.

It's important to lock-in your auto rate as rates can rise at any time. Make sure to have proof of insurance on hand for this step.

![]()

Step 3

You're ready to go!

After you're pre-approved, we take care of loose ends with your current loan. You can schedule your first payment up to 90 days after closing.

Get busy planning another adventure with your savings.

-

New Auto - rates as low as 5.19% APR1 for 48 months

-

New Auto - rates as low as 5.39% APR1 for 60 months

No payment for the first 90 days of your loan2

- Rates include a 0.25% discount for having a Benefits Checking account

Instant Offers

Get personalized offers for auto, credit card, and personal loans without impacting your credit score.

Love your new ride but not your payment? Refinance with OneAZ to lower your monthly payment today.

As a OneAZ member, you will also take advantage of these great perks:

- Used auto loan refinance rates as low as 5.39% APR for 48-month terms3

- Used auto loan refinance rates as low as 5.59% APR for 60-month terms3

- Rates displayed include a 0.25% discount for having a Benefits Checking account

- Pay online from any bank

- No penalty for paying early

- Flexible payment options and terms

- Apply and close your loan online

- Extended warranties and GAP products

- Free CARFAX report upon request with application submission

Need more information?

Chat with a loan expert about your needs.

Call or email anytime.

Already Submitted an Application?

You can click the link below to check the status of your application.

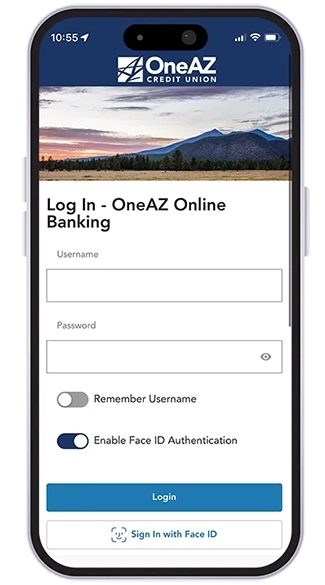

Do it all with the OneAZ Mobile Banking app.

![]()

Deposit checks

![]()

Transfer funds

![]()

Pay your bills

![]()

Chat with an associate

![]()

Locate an ATM

Download Now

Rates as of April 1, 2025.

1 APR = Annual Percentage Rate. New Auto Loans are 2024 and newer vehicles, in which the equitable or legal title has not been transferred to an ultimate purchaser. Term of up to 48 months; with an APR of 5.19% and estimated monthly payment of $23.12 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.

1 90 Days No Payment option will extend your loan by three (3) months, and finance charges will accrue on unpaid principal. This offer does not apply to refinancing existing OneAZ loans, Credit Flex, or Indirect loans.

1 APR = Annual Percentage Rate. Used vehicles must be 15 years old or less to qualify for a loan. Term of up to 48 months; with an APR of 5.39% and estimated monthly payment of $23.21 per $1,000.00 borrowed. Term of up to 60 months; with an APR of 5.59% and estimated monthly payment of $19.15 per $1,000.00 borrowed. Other finance options available. Taxes and fees are not included. The rate may vary depending on each individuals’ credit qualifications, loan term and collateral. Other terms and conditions may apply. Loans through dealers do not qualify for promotional rate. Rates include a 0.25% discount for having a Benefits Checking account. Visit our Checking page for more information. Membership qualifications apply. For membership eligibility, visit our Membership page.